When you pick up a prescription for generic lisinopril or metformin, you probably assume the price is low because the drug is cheap to make. But here’s the truth: the generic drug you pay $4 for at the pharmacy may have cost the wholesaler just 25 cents - and yet, that 25-cent item generated more profit for the distributor than a $100 branded pill. This isn’t a glitch. It’s the system.

The Three-Tier Machine

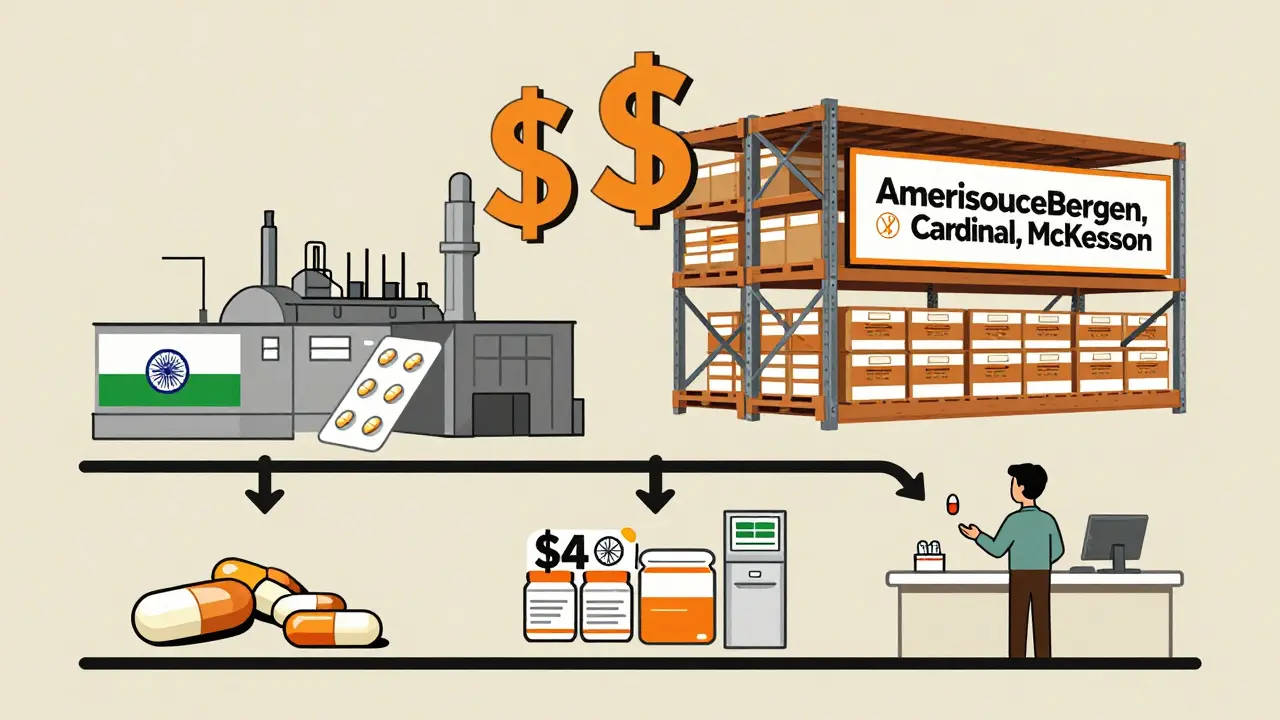

The path from a generic drug factory in India or China to your local pharmacy isn’t direct. It runs through a tightly controlled pipeline: manufacturer → wholesaler → pharmacy. This isn’t new. The Prescription Drug Marketing Act of 1987 formalized it. But what’s changed is who makes the money. The three biggest wholesalers - AmerisourceBergen, Cardinal Health, and McKesson - control about 85% of the U.S. market. That’s not competition. It’s a cartel. And they don’t make their money on volume alone. They make it on the math.Why Generics Are the Wholesaler’s Goldmine

Branded drugs? Manufacturers take the lion’s share. Gross margins can hit 76%. But with generics, the rules flip. Manufacturers are forced to slash prices to win contracts. They might make only 49.8% gross margin. Meanwhile, the wholesaler? They make 11 times more profit per dollar spent on generics than on branded drugs. In 2009, generics made up just 9% of wholesale revenue - but 56% of their gross profits. How? Because wholesalers don’t need to carry much inventory. A generic pill is cheap. A warehouse can hold millions of units without tying up capital. That means their return on assets spikes after a generic launch. A $100,000 investment in branded drugs might sit for months. The same investment in generics? Turns over 10 times faster.How Pricing Actually Works

Wholesalers don’t just slap on a markup. They use four pricing strategies - and tiered volume discounts are the most powerful.- Cost-plus pricing: Add 20-50% to production cost. Simple, but risky if competitors undercut you.

- Market-based pricing: Match what the Big Three charge. Most smaller players do this. It’s safe, but you never win.

- Value-based pricing: Rare in generics. Too hard to prove added value when the pill is identical to the next one.

- Tiered pricing: This is where the real leverage lives. Buy 100 units? Get 10% off. Buy 500? Get 20% off. A pill that costs $1.00 for small orders drops to $0.80 for bulk. But the wholesaler’s cost? Still 25 cents. That’s a 220% margin on the discount.

The Inversion: Who Really Profits?

Here’s the kicker: the people who make the most money from generic drugs aren’t the makers. They’re the middlemen.- Wholesalers make 11 times more profit per dollar on generics than on branded drugs.

- Pharmacies make 12 times more.

- PBMs (pharmacy benefit managers) make four times more.

Why Prices Keep Changing

Generic drug prices aren’t stable. They swing wildly. During 2021 and 2022, prices fell. Too many manufacturers entered the market. Supply outpaced demand. But in 2023, things flipped. Shortages hit. One company stops making a generic blood pressure pill? Price jumps 300% overnight. That’s not inflation. That’s market manipulation. The Big Three don’t cause shortages - but they don’t fix them either. They wait. And when prices spike, they buy up remaining stock. Then they raise their prices. The pharmacy pays more. The patient pays more. The manufacturer? They’re still stuck with the same contract.Who Controls the Price?

It’s not the FDA. Not the manufacturer. Not even the pharmacy. It’s the wholesaler. They set the list price. They decide who gets what and when. They negotiate with PBMs behind closed doors. They influence which generics get stocked and which sit in warehouses. They’re the gatekeepers. And because they control 85% of the market, there’s no real alternative.

Write a comment