Every January, millions of people on Medicare Part D get a surprise: their favorite medication is no longer covered the same way-or at all. It’s not a mistake. It’s a formulary update. These are the annual changes insurance companies and pharmacy benefit managers (PBMs) make to decide which drugs they’ll pay for, at what price, and under what rules. In 2025, these changes hit harder than ever because of the Inflation Reduction Act (IRA), which reshaped how prescription drugs are covered-and who pays for them.

What’s Actually Changing in 2025?

The biggest shift? The end of the "donut hole." For years, Medicare beneficiaries hit a coverage gap after spending $4,430 on drugs in 2024. Once they entered that gap, they paid a lot more out of pocket-sometimes over 25% of the drug’s full price. Starting January 1, 2025, that gap is gone. You’ll get 100% coverage from the moment you hit your initial coverage limit ($5,030 in 2025) until you hit the catastrophic threshold ($8,000). After that, you pay just 5% or a small copay, whichever is higher. But here’s the catch: while your out-of-pocket costs are capped at $2,000 per year for the first time, insurers are pushing harder to get you onto cheaper drugs. That means more generic switching.How Formularies Work: Tiers and Costs

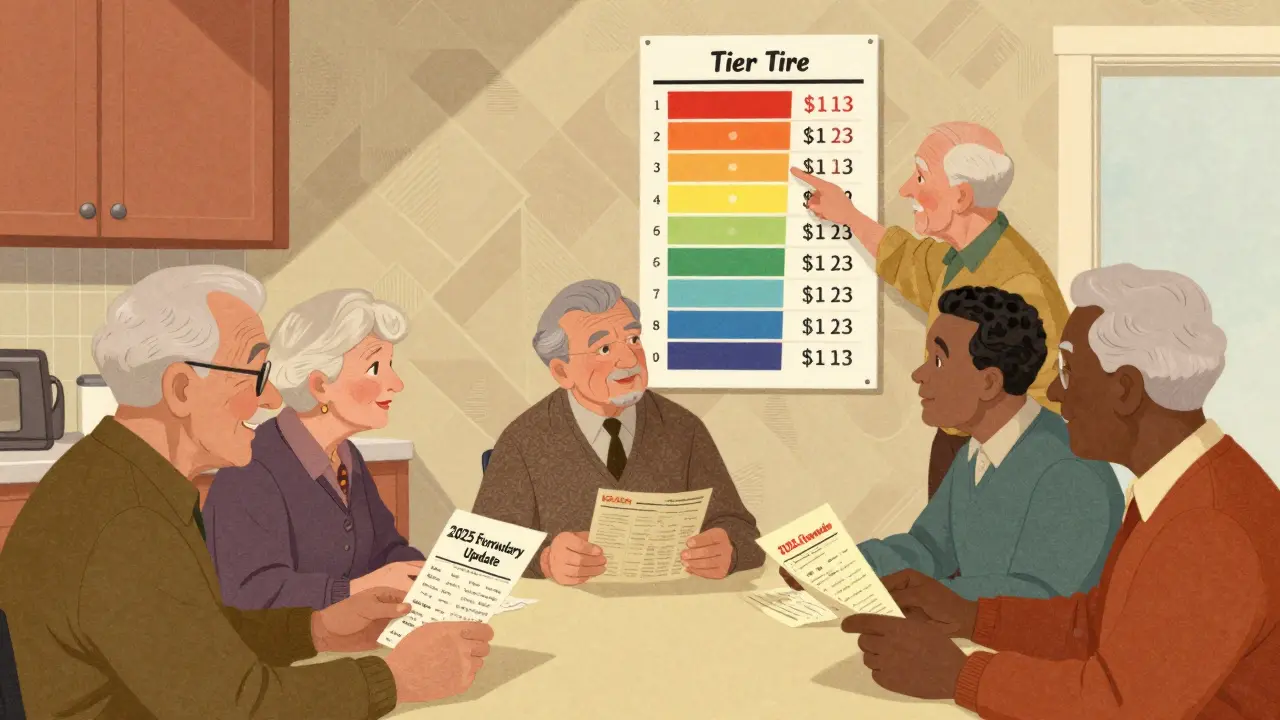

Insurance plans organize drugs into tiers. Each tier has a different price tag for you. Here’s what the 2025 tiers look like, based on CMS data:- Tier 1 (Preferred Generics): $1-$10 copay. These are the drugs insurers want you to take. Think metformin, lisinopril, or atorvastatin.

- Tier 2 (Non-preferred Generics & Preferred Brands): Around $47. These are still affordable, but insurers prefer you stick with Tier 1 if possible.

- Tier 3 (Non-preferred Brands): Around $113. If your drug is here, your plan wants you to switch to a generic.

- Specialty Tier: $113 or 25% coinsurance. These are high-cost drugs like biologics for arthritis, cancer, or autoimmune conditions.

Why Are Insurers Pushing Generics So Hard?

It’s not just about saving money-it’s about how they make money. Before the IRA, PBMs made more profit when they pushed expensive brand-name drugs because they got rebates from manufacturers. Now, the law changed the rules. Insurers are no longer rewarded for covering high-cost brands. Instead, they’re incentivized to switch patients to generics and biosimilars-drugs that work the same way but cost 70-90% less. Take Humira, for example. The original biologic costs over $7,000 a month. Its biosimilar, Amjevita, costs around $1,200. The difference isn’t just in price-it’s in how much the insurer saves. That’s why CVS Caremark, UnitedHealth’s OptumRx, and Express Scripts are removing Humira from their formularies and replacing it with biosimilars. And they’re not alone. In 2025, 78% of standalone Medicare Part D plans are actively pushing patients to switch to generics or biosimilars. That’s nearly double the rate in Medicare Advantage plans.What Gets Removed? What Gets Added?

Some drugs are being completely dropped. CVS Caremark’s 2025 formulary removed nine specialty drugs, including Herzuma and Ogivri. But they added 18 new ones, including biosimilars like Kanjinti and Trazimera. These aren’t random changes. They’re strategic. If a biosimilar exists and the FDA says it’s "highly similar," insurers feel safe replacing the original. Diabetes and respiratory drugs are seeing the most changes. Humalog insulin, once covered at $35 per vial, was moved to a higher tier by UnitedHealthcare in 2024. One user reported their copay jumped to $113 overnight. That’s the kind of shock that sends people scrambling. But not all changes are bad. Some people are saving hundreds. "My switch from Humira to Amjevita saved me $450 a month," said one user on HealthUnlocked. "No difference in how I feel. Just less pain at the pharmacy."

What If Your Drug Is Removed or Moved?

You’re not stuck. You have options. First, you’ll get a notice. By law, insurers must give you at least 60 days’ notice before changing coverage for a drug you’re already taking. If it’s a newly approved generic, they only need 30 days. But here’s the kicker: you can request an exception. There are two types:- Standard Exception: You or your doctor asks for your drug to be covered anyway. Takes up to 72 hours. Approval rate: 82.3% for tier changes.

- Expedited Exception: For urgent medical needs. Gets processed in 24 hours. Approval rate drops to 47.1% if the drug is completely excluded.

How to Prepare Before January 1

You don’t have to wait for a letter. Do this now:- Check your plan’s formulary. Go to your insurer’s website. Look for "2025 Formulary Changes" or "Drug List Updates."

- Search for every drug you take. Note the tier. If it moved up, prepare for a cost increase.

- Ask your pharmacist: "Is there a generic or biosimilar I can switch to?" They know the latest changes better than your doctor sometimes.

- If your drug is being removed, ask your doctor for a letter supporting why you need it. That’s your ticket to an exception.

- Call your plan’s member services. Ask: "Will I get a 30-day transitional supply if my drug changes?" Most plans offer this.

The Big Picture: What’s Coming in 2026

2025 is just the warm-up. In January 2026, the Medicare Drug Price Negotiation Program kicks in. For the first time ever, the government will negotiate prices for 10 high-cost drugs-including Stelara, Prolia, and Xolair. If your drug is on that list, your plan MUST cover it, and it must be priced at least 25% lower than before. That’s huge. It means even if your insurer tries to push you off a drug, they can’t. They have to cover it at the new, lower price. And by 2029, that list grows to 20 drugs. Meanwhile, biosimilar adoption is accelerating. In 2024, the FDA approved 17 new biosimilars. That’s a 34% jump from 2023. Experts predict nearly half of targeted therapies will be biosimilars by 2027. That means even more switching.

Who’s at Risk?

Not everyone. If you’re on a generic like metformin or levothyroxine, you’re probably fine. But if you’re on:- A biologic for rheumatoid arthritis, psoriasis, or Crohn’s

- An insulin or GLP-1 agonist for diabetes

- A specialty drug for cancer or multiple sclerosis

What You Can Do Right Now

1. Review your formulary before December 1. Don’t wait for January. 2. Call your pharmacist. They know what’s changing and what alternatives exist. They’ve seen the patterns. 3. Ask your doctor for a letter. If your drug is being removed, get a written statement explaining why switching could harm you. That’s your strongest tool. 4. Know your rights. You can appeal. You can get a temporary supply. You can ask for a lower tier. Use them. 5. Join the conversation. If your plan is making changes that hurt people, speak up. Medicare.gov forums are full of stories. Your voice matters.Final Thought: This Isn’t Just About Cost

Insurance companies aren’t trying to hurt you. They’re trying to survive. The IRA cut their profits by 18-22% through 2027. To stay solvent, they’re shifting costs to patients-and pushing generics hard. But you’re not powerless. You have a voice. You have rights. And you have time-before January 1-to act. Don’t wait for a letter. Don’t wait for your prescription to run out. Check your formulary now. Talk to your pharmacist. Ask your doctor. Save yourself the shock-and the cost.What is a formulary update?

A formulary update is when your health insurance plan changes which drugs it covers, how much you pay for them, or what rules apply (like requiring prior authorization). These updates happen every year, usually effective January 1, and can include adding, removing, or moving drugs to different cost tiers.

Why are my prescription costs going up even though the donut hole is gone?

While the donut hole is gone and your out-of-pocket costs are capped at $2,000, insurers are shifting more drugs to higher tiers to encourage switching to cheaper generics or biosimilars. So even if your total annual cost is lower, your monthly copay might jump from $35 to $113 overnight if your drug moves from Tier 2 to Tier 3.

What’s the difference between a generic and a biosimilar?

Generics are exact chemical copies of brand-name drugs, usually small-molecule pills. Biosimilars are highly similar versions of complex biologic drugs made from living cells-like Humira or insulin. They’re not identical, but the FDA says they work the same way with no meaningful difference in safety or effectiveness. Biosimilars cost 70-90% less than the original biologic.

Can I fight a formulary change?

Yes. You can file an exception request with your plan. If your doctor writes a letter explaining why switching would harm you, your chances of approval are high-especially for tier changes. For drugs being completely removed, approval is harder, but still possible. Expedited requests are available if you’re at risk of serious harm.

When should I check my formulary changes?

Check between October and December each year. That’s when insurers release their updated formularies for the next calendar year. Waiting until January means you might run out of medication before you can get an exception or switch to a new drug.

What drugs are being affected most in 2025?

Drugs in three categories are seeing the biggest changes: biologics for autoimmune diseases (like Humira, Enbrel), insulin and GLP-1 agonists for diabetes (like Humalog, Ozempic), and specialty cancer drugs. These are the most expensive, so insurers are pushing biosimilars and generics hardest in these areas.

Will the new drug price negotiations in 2026 help me?

Yes-if your drug is one of the 10 selected for negotiation in 2026 (like Stelara, Prolia, or Xolair). Your plan must cover it at the new, lower price. That means even if your insurer tried to remove it, they can’t. You’ll get it at a discount, and it won’t count against your $2,000 cap. This is a major win for people on high-cost meds.

Write a comment