When you take a pill for high blood pressure, an antibiotic, or a diabetes medication, there’s a good chance it came from India. The country doesn’t just make medicines-it supplies them to nearly every corner of the planet. More than 20% of all pharmaceuticals shipped worldwide by volume are made in India. That’s not a small number. It’s the backbone of global access to affordable healthcare.

How India Became the Pharmacy of the World

India’s rise as a global drugmaker didn’t happen by accident. In the 1970s, the country changed its patent laws. Before that, foreign companies held exclusive rights to drugs, making them expensive and out of reach for most people. India’s 1970 Patents Act removed product patents on medicines. Instead, it only protected the process of making a drug. That meant Indian companies could legally copy any patented medicine as long as they used a different manufacturing method. This wasn’t just clever-it was revolutionary. Suddenly, life-saving drugs like antibiotics, antivirals, and heart medications became cheap. A drug that cost $10,000 a year in the U.S. could be made in India for $100. By the 1990s, Indian manufacturers were exporting these generics to Africa, Latin America, and Southeast Asia. By the 2000s, they were winning contracts with the U.S. government and the World Health Organization. Today, India produces over 60,000 generic drugs and more than 500 active pharmaceutical ingredients (APIs). It’s the world’s largest vaccine producer-supplying over 60% of all vaccines used globally. That includes everything from polio shots to COVID-19 vaccines.The Numbers Behind the Supply Chain

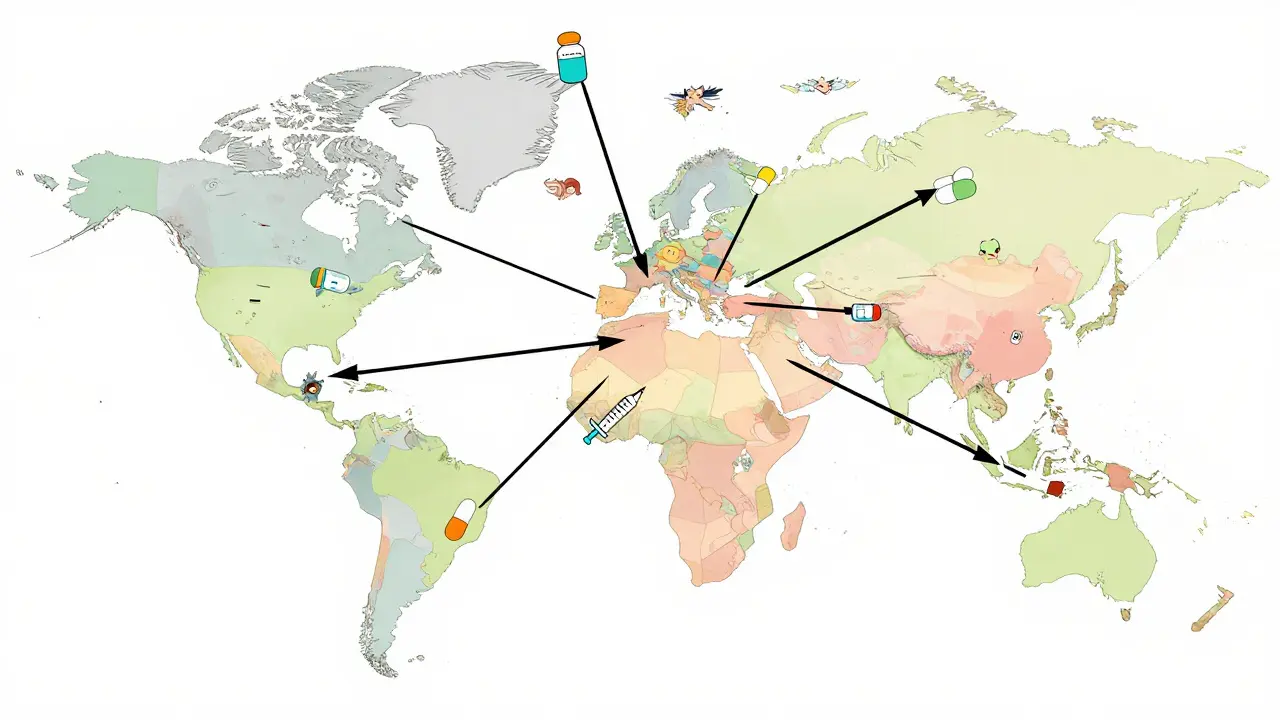

The scale is staggering. India has over 10,000 drug manufacturing units and more than 3,000 pharmaceutical companies. Of those, 650 facilities are approved by the U.S. Food and Drug Administration (FDA)-the most outside the United States. Another 2,000+ plants meet WHO Good Manufacturing Practice (GMP) standards, allowing exports to over 150 countries. In 2023-24, the Indian pharmaceutical industry was worth $50 billion. By 2030, it’s expected to hit $130 billion. Exports alone made up $25 billion in 2024. That’s more than the entire pharmaceutical output of many European countries. India supplies:- 40% of all generic drugs in the United States

- 33% of generic medicines used by the UK’s National Health Service

- 50% of all medicines imported by Sub-Saharan Africa

Why Indian Drugs Are So Much Cheaper

The cost difference isn’t magic-it’s structure. Indian manufacturers operate with lower labor costs, streamlined supply chains, and no need to recoup billions in R&D spending. Branded drug companies spend years and billions developing a new medicine. Once the patent expires, Indian firms reverse-engineer it and start making it for pennies. A typical branded drug might cost $100 per pill. The Indian generic version? Often under $2. That’s an 80-90% price drop. And here’s the key: quality isn’t sacrificed. Most Indian plants follow the same FDA and EMA rules as U.S. and European factories. In fact, FDA inspection compliance rates for Indian facilities jumped from 60% in 2015 to 85-90% today. That’s why 87% of U.S. patients who use Indian generics report satisfaction-according to PharmacyChecker.com. They get the same active ingredient, same dosage, same effect. The only difference? The price tag.

Who Makes These Drugs? The Big Players

It’s not just small factories. India’s generic market is led by a handful of giants:- Sun Pharma-the world’s largest generic drugmaker by market cap, valued at over $43 billion

- Cipla-famous for producing low-cost HIV drugs during the AIDS crisis

- Dr. Reddy’s Laboratories-a major supplier of complex injectables and biosimilars

- Biocon-a leader in biosimilars, including cancer treatments

The Hidden Weakness: Dependence on China

Despite all its strengths, India has one big vulnerability: it depends on China for 70% of its active pharmaceutical ingredients (APIs). That’s the raw chemical that makes the drug work. Without it, no pills can be made. This became painfully clear during the pandemic. When China shut down factories, India faced shortages of basic antibiotics and paracetamol. The government responded with a ₹3,000 crore ($400 million) incentive program to build domestic API plants. The goal? To cut China’s share to 53% by 2026. It’s a race against time. Building API plants takes years and billions in investment. Right now, only a handful of Indian companies can produce high-quality APIs at scale. Most still rely on Chinese imports, which means global drug supply chains remain fragile.

Write a comment